The News: Marvell Technology Group Ltd. (NASDAQ: MRVL), a leader in infrastructure semiconductor solutions, today reported financial results for the fourth fiscal quarter and the full fiscal year, ended January 30, 2021.

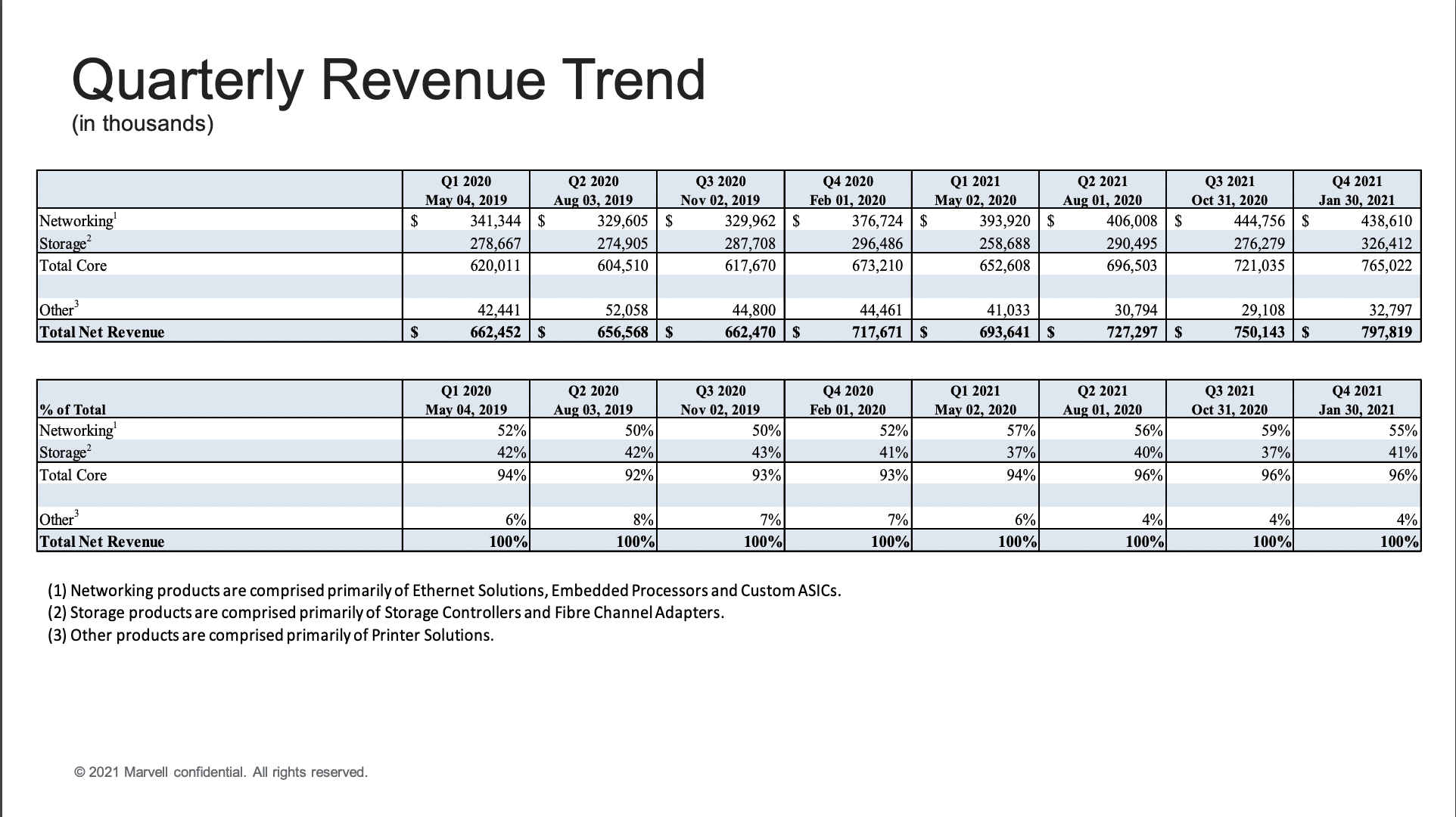

The Santa Clara, Calif.-based company delivered an adjusted 29 cents EPS on sales of $797.8 million in the quarter ended Jan. 30. Analysts expected Marvell earnings of 29 cents a share on sales of $794.3 million. On a year-over-year basis, Marvell earnings rose 71% while sales climbed 11%.

It was Marvell’s fourth straight quarter of accelerating earnings growth. However, top line revenue growth slowed in the period after three quarters of quickening growth.

Read the full earnings release from Marvell.

Analyst Take: As demand for semiconductors continues to be strong, Marvell delivered a solid result that builds on its string of YoY growth.

This quarter, the company’s growth mostly came from its Networking business, which benefitted from the increasing 5G rollout and Cloud’s continued strength. The overall growth for the Networking business was 22%.

Inphi Purchase Still on Track

The company announced its intention to acquire Inphi for $10 billion during the calendar 4th quarter. This acquisition is set to close in the second half of 2021

Inphi, which isn’t necessarily a household name, adds broad capabilities in the data center fabric space producing semiconductors and optical components for 10G-800G connectivity. The addition of Inphi to Marvell will serve as a driver in its 5G and Cloud endeavors, which are key growth areas for the company over the next few years.

A Look at Marvell FY ’22 Q1

The company provided first-quarter guidance that equated to about 15% YoY growth at the mid-point. I see this number as a sign of confidence that the company’s focus areas are gaining momentum and that there are no major supply issues related to the semiconductor shortages. This was also confirmed in the earnings call comments provided by CEO Matt Murphy.

Overall Impressions

Marvell is in a good market position and looks set to pounce on the growing demand in Cloud and 5G. The company’s leadership under CEO Matt Murphy has been steady-handed, and the ambition is becoming more visible through the company’s product development. With 5G and Cloud being a big part of the future, the company is building its pipeline in datacenter and automotive.

All of this amounts to a solid quarter and year for Marvell, which is looking on pace to continue its momentum into the new fiscal year. Marvell is a company on the rise, aligned to many of the best end-markets in the semiconductor space, including 5G, Cloud, and auto. All markets that are poised to grow, leaving a prime opportunity for Marvell to grow and gain share along with them.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

The Zoom Boom Continues as Q4 Finishes Well Above Expectations

DoD Partners with GLOBALFOUNDRIES to Manufacture Secure Chips

Microsoft Deepens Integration Between Dynamics 365 and Teams

Image: Marvell

Author Information

Daniel is the CEO of The Futurum Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise.

From the leading edge of AI to global technology policy, Daniel makes the connections between business, people and tech that are required for companies to benefit most from their technology investments. Daniel is a top 5 globally ranked industry analyst and his ideas are regularly cited or shared in television appearances by CNBC, Bloomberg, Wall Street Journal and hundreds of other sites around the world.

A 7x Best-Selling Author including his most recent book “Human/Machine.” Daniel is also a Forbes and MarketWatch (Dow Jones) contributor.

An MBA and Former Graduate Adjunct Faculty, Daniel is an Austin Texas transplant after 40 years in Chicago. His speaking takes him around the world each year as he shares his vision of the role technology will play in our future.