The News: Nvidia reported earnings on Wednesday for its second fiscal quarter that ended on August 1, beating Wall Street estimates because of strong graphics cards sales.

However, Nvidia’s cryptocurrency chip products, CMP, had lower sales at $266 million than the $400 million the company predicted in May. Shares of Nvidia were up over 1% in after-hours trading.

Here’s how the chipmaker did versus Refinitiv consensus estimates:

- Earnings: $1.04, adjusted, versus $1.01 expected

- Revenue: $6.51 billion, versus $6.33 billion expected

Nvidia forecast $6.8 billion in revenue in the current quarter, beating Refinitiv expectations of $6.5 billion.

Read the full news item on CNBC.

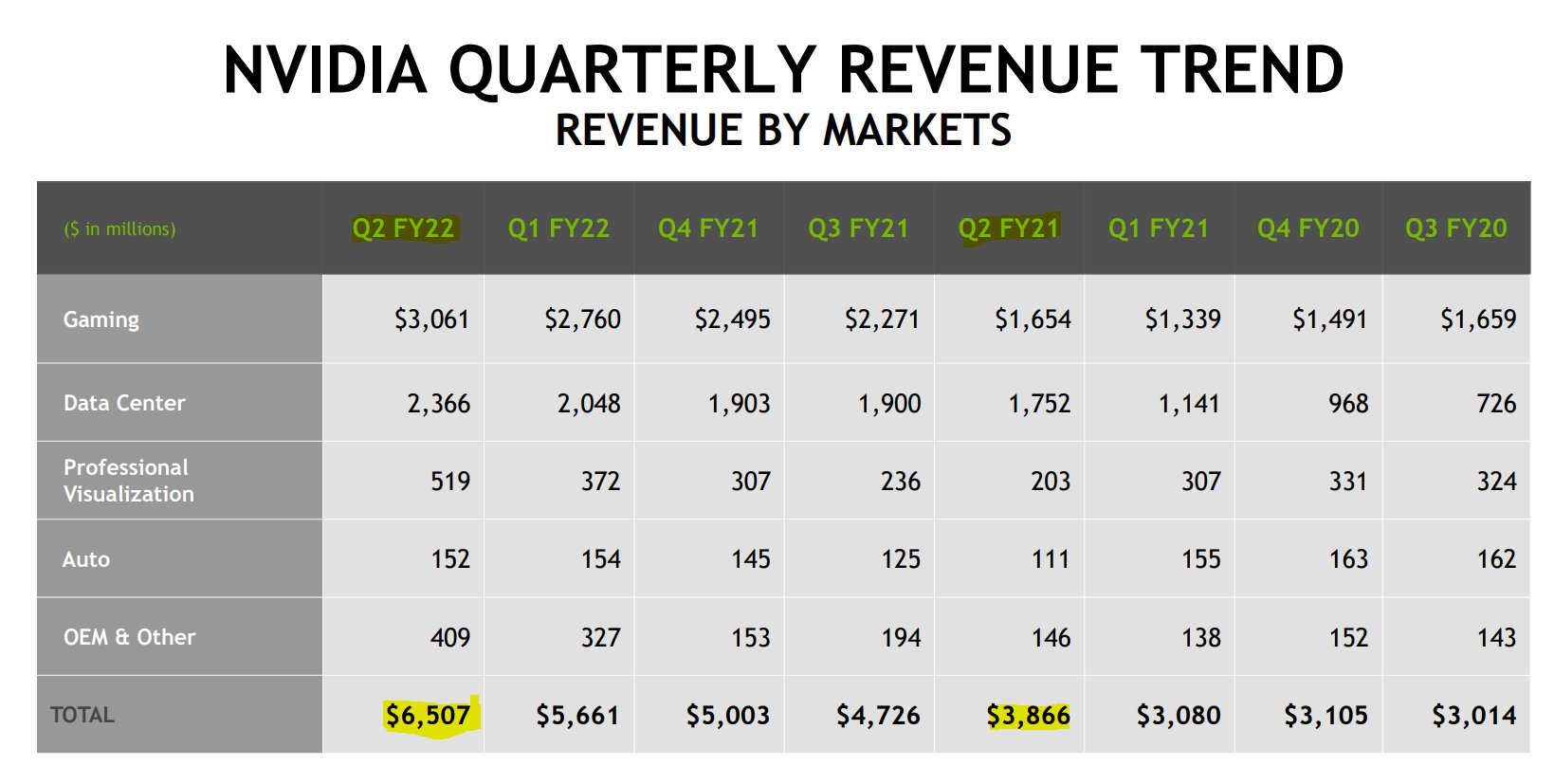

Analyst Take: NVIDIA’s momentum continued into the second quarter of its fiscal year as the company realized several record-breaking results, including:

• Record revenue of $6.51 billion, up 68 percent from a year earlier

• Record Gaming revenue of $3.06 billion, up 85 percent from a year earlier

• Record Data Center revenue of $2.37 billion, up 35 percent from a year earlier

• Record Professional Visualization revenue of $519 million, up over 100% YoY

This quarter’s results represent 10 straight quarters outpacing expectations for both the top and bottom line. Impressive results at face value, and as you dig deeper, there isn’t much not to like. With Mellanox firmly included in the numbers for the past 4 quarters, we are seeing its robust impact on the acquisition, and if you track the past 10 quarters, you can see in its key segments the growth has been strong, and while growth in smaller categories have lagged, this quarter even saw a big pop and record breaking revenue for its ProViz business unit and large YoY and sequential growth in its OEM unit most likely powered by growth in its Crypto Mining Business. However, the crypto growth did fall short of expectations by about 33%.

The excitement around NVIDIA will continue throughout the year, and the pending acquisition of Arm will continue to be a hot topic around NVIDIA as investors are beginning to fully understand the implications that this acquisition could have for NVIDIA’s long term trajectory. I stand by my assessment that this will be a complicated transaction that will all but certainly face legal challenges and regulatory scrutiny, which we began to hear more about this past quarter, but there are no strong indicators at this point in time to suggest it won’t be completed–Such an outcome will be very good for NVIDIA as it provides the company a path to compete in the CPU space and add a licensing business with global scale.

Let’s dive into the results for the companies two largest segments Gaming and Data Center.

Gaming Sees Another Quarter of Record-Breaking Revenue

Gaming reached a new record-breaking number at $3.06 billion, reflecting a growth of about 10% on a sequential basis and 85% YoY. These numbers were backed by its second generation RTX products including the 3080 and 3070. RTX momentum also saw its number of titles usurp 130 during the quarter. Also, GeForce Now continues to gain momentum surpassing 1,000 titles making it the largest available streaming service for cloud gaming.

NVIDIA’s gaming business continues to be a pillar of its upward trajectory, representing nearly 50% of its revenue each of the past four quarters.

Datacenter Also Breaks a Record With This Quarter’s Results

Datacenter continues to be a fast growth component of NVIDIA’s business seeing growth both through acquisition and organic adoption of its leading AI solutions. This quarter marked yet another record-breaking revenue number, coming in at $2.37 billion. This reflects an all-inclusive YoY growth number of 35%. Sequential results for datacenter came in at 16% growth and this number reflected a fourth consecutive record-breaking result.

The quarter saw a mass of announcements from the datacenter business unit, with several warranting extra attention including:

-

Unveiled NVIDIA Base Command™ and Fleet Command™ – software platforms optimized for NVIDIA-powered systems running NVIDIA AI software – to develop, deploy, and manage AI applications across the enterprise and the industrial edge.

-

Announced NVIDIA AI LaunchPad, a program delivered by hybrid-cloud providers giving enterprises instant AI infrastructure, with Equinix as the first partner.

-

Launched TensorRT™ 8, the latest generation of NVIDIA’s AI inference software, delivering record-setting speed for natural language processing and other AI applications.

-

Announced NVIDIA® technology supports 342 supercomputers on the latest TOP500 list, including 70 percent of all new systems and 8 of the top 10, and powers 35 of the top 40 greenest systems.

-

Set performance records across all eight AI training benchmarks for commercially available systems in the latest MLPerf results, delivering up to 3.5x more performance than last year’s scores.

-

Announced there are now more than 55 NVIDIA-Certified Systems™ offered by the world’s leading server makers supporting NVIDIA AI Enterprise software, with many powered by NVIDIA BlueField®-2 DPUs and NVIDIA DOCA™.

-

Supported Microsoft Azure’s general availability of NVIDIA A100 GPU VMs, their most powerful virtual machines for supercomputer-class AI and HPC workloads.

-

Worked with Google Cloud to establish the first AI-on-5G Innovation Lab, helping to accelerate the creation of smart cities, smart factories and other 5G and AI applications.

While these were only a portion of the highlighted datacenter updates from this quarter, the new offerings, supercomputing wins, and major public cloud-adoption updates allude to the momentum that I have been tracking within NVIDIA’s datacenter segment. I expect the datacenter business will continue to grow as the company’s investments in AI are rapidly evolving to address much more than training, addressing the significant opportunities for enterprise AI. This growth will be further emphasized by the overall TAM expansion for enterprise AI as use cases and adoption continue to scale and gain further definition.

Overall Impression of NVIDIA Q2 Earnings

NVIDIA started off its FY ’22 with strong momentum and record breaking results in 3 of its segments including its two largest. The momentum for the company seems to be gaining steam through innovation, acquisition(s), and of course, record-breaking results. This is further accelerated by its positioning in a key growth area (AI), and seems to be working around any macroeconomic forces including the chip shortages that have constrained many industries.

While the gaming results continue to be outstanding, for me, the most notable thing is the rapid momentum of its datacenter business. With another record breaking result, it is clear that AI adoption is accelerating, and NVIDIA is continuing to operate as the market leader in this space while holding onto its AI Training market share and expanding its influence in the inference space.

With forward-looking revenue of $6.80 billion coming in ahead of analyst expectations, it suggests we will see another positive quarter ahead. It will be interesting to keep tabs on the growth, the impact of supply chain interruptions on its Q3 guidance, and the further development of the Arm acquisition as regulators and competitors continue to raise concerns about the deal.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice. Neither the Author or Futurum Research holds any positions in any companies mentioned in this article.

Other insights from Futurum Research:

Google Cloud Rolls Out Google Cloud Retail Search Functionality, Delivers Big Assist to Retailers

What Does the Poly Network Hack Mean for DeFi

Microsoft Acquires Peer5 to Address Demand for Live Video Streaming

Image Credit: NVIDIA

Author Information

Daniel is the CEO of The Futurum Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise.

From the leading edge of AI to global technology policy, Daniel makes the connections between business, people and tech that are required for companies to benefit most from their technology investments. Daniel is a top 5 globally ranked industry analyst and his ideas are regularly cited or shared in television appearances by CNBC, Bloomberg, Wall Street Journal and hundreds of other sites around the world.

A 7x Best-Selling Author including his most recent book “Human/Machine.” Daniel is also a Forbes and MarketWatch (Dow Jones) contributor.

An MBA and Former Graduate Adjunct Faculty, Daniel is an Austin Texas transplant after 40 years in Chicago. His speaking takes him around the world each year as he shares his vision of the role technology will play in our future.