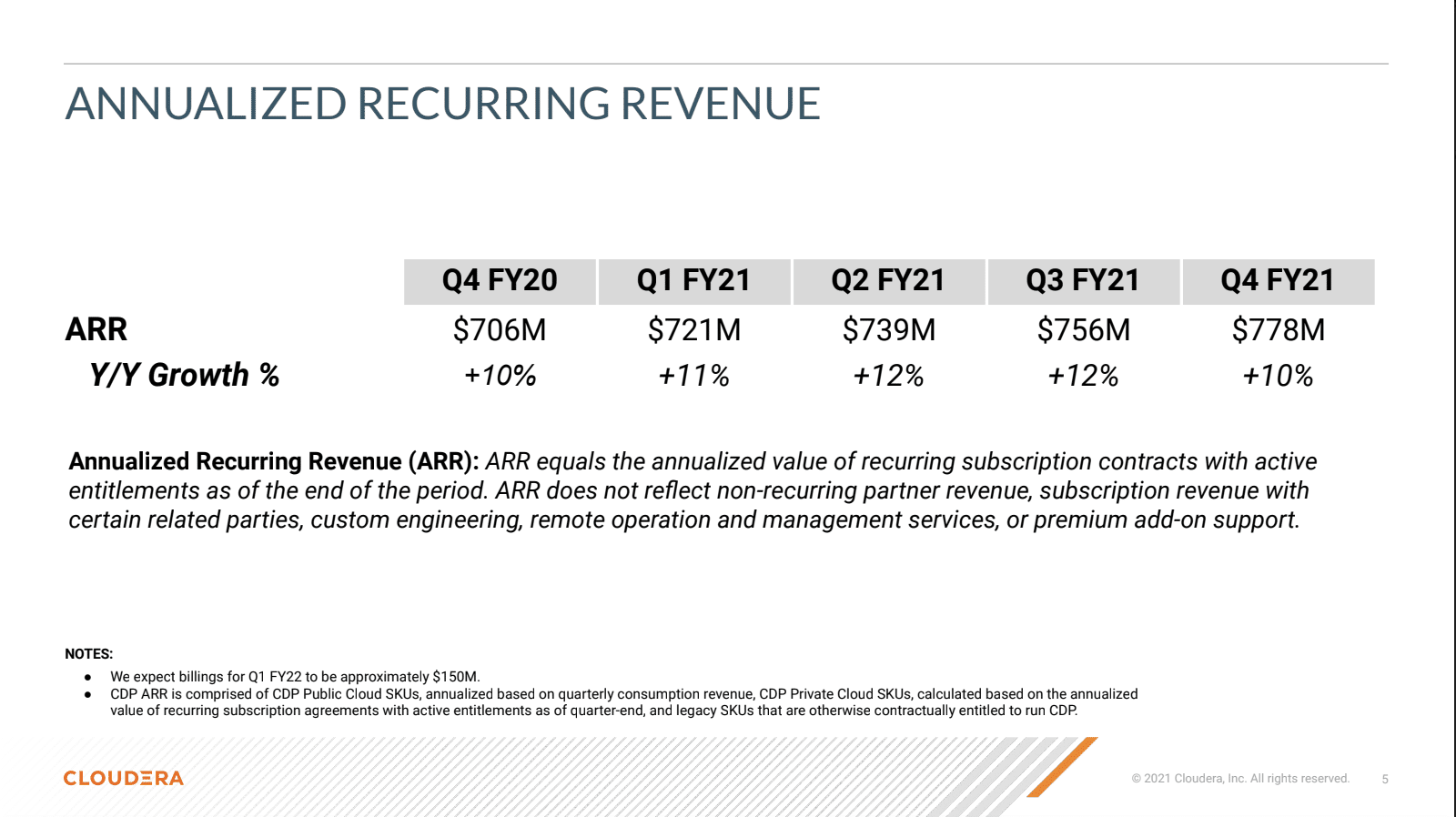

The News: SANTA CLARA, Calif., March 10, 2021 /PRNewswire/ — Cloudera, Inc. (NYSE: CLDR), the enterprise data cloud company, reported results for its fourth quarter and fiscal year 2021, which ended January 31, 2021. Total revenue for the fourth quarter was $226.6 million, an increase of 7% as compared to the fourth quarter of fiscal 2020. Subscription revenue was $206.8 million, an increase of 14% as compared to the fourth quarter of fiscal 2020. Annualized Recurring Revenue grew 10% year-over-year. Read the full release from Cloudera’s Investor Relations.

Analyst Take: The overall performance this quarter and for the full year for Cloudera should give a good feeling to Cloudera investors as well as shines a light on the steady increase in demand for open source tools that enable enterprises to extract more value from their data.

The numbers not only beat the street expectations, but more importantly showed YoY growth, which has challenged parts of enterprise tech. Also, the positive EPS (Non-GAAP) represents a positive bottom line result building on its Q3 EPS beat, which came to the surprise of analysts.

I believe the stronger than expected results are a byproduct of a company that is executing on the demand for analytics. A few of the highlights for Cloudera this quarter:

- Annualized Recurring Revenue at the conclusion of fiscal 2021 was $778 million, representing 10% year-over-year growth

- GAAP subscription gross margin for the quarter was 87%, up from 84% in the fourth quarter of fiscal 2020

- Non-GAAP subscription gross margin for the quarter was 91%, up from 88% in the fourth quarter of fiscal 2020

- Repurchased 26 million shares of Cloudera common stock

- CDP Operational Database now available on Amazon Web Services (AWS) and Microsoft Azure

- Partnered with NVIDIA to accelerate processing for enterprise data engineering and data science workflows on Cloudera Data Platform

In short, double digit growth in recurring revenue, strong growth in gross margin on subscription services, a substantial stock buyback, improving migration from its legacy offering to its CDP offering, and new partnerships with key hyperscalers and AI leaders provide a foundation for a good quarter that wrapped up a solid fiscal year campaign for Cloudera.

Recurring Revenue and Customer Growth – The Cloudera Number to Watch

A couple of numbers to watch to gauge the continued momentum of Cloudera in its space will be the recurring revenue growth, which has seen moderate growth in six of the past seven quarters. This quarter’s 10% growth once again falls in line with many of its recent quarters in the low double-digit range. With its new product mix and the GA of Cloudera Private Cloud that is now in its second full quarter of reporting, there may be opportunity to see that growth accelerate through expanded relationships with existing and net new customers.

Cloudera has deep roots throughout the Fortune 500, and considers the Fortune 2000 as its key targets. What I am looking for is a better sense of how it expands revenue with its customers through diversified offerings that drive greater revenue on a subscription basis. This has been, in practice, the Cloudera approach over the past several quarters. It will be important for Cloudera to continue its focus on adapting to the growing hybrid cloud architecture and to keep an eye on competition from hyperscale cloud providers, which have seen their offerings expand substantially over the past two years.

This quarter the company said to have more than 1,000 customers that spend more than $100,000 recurring and expanded from 179 to 190 that are now above $1,000,000. Perhaps more important to note is the significant transition to its new CDP Private Cloud service, which Cloudera said over 50% of its large customers (over $1 million) have started. These numbers are important to keep an eye on.

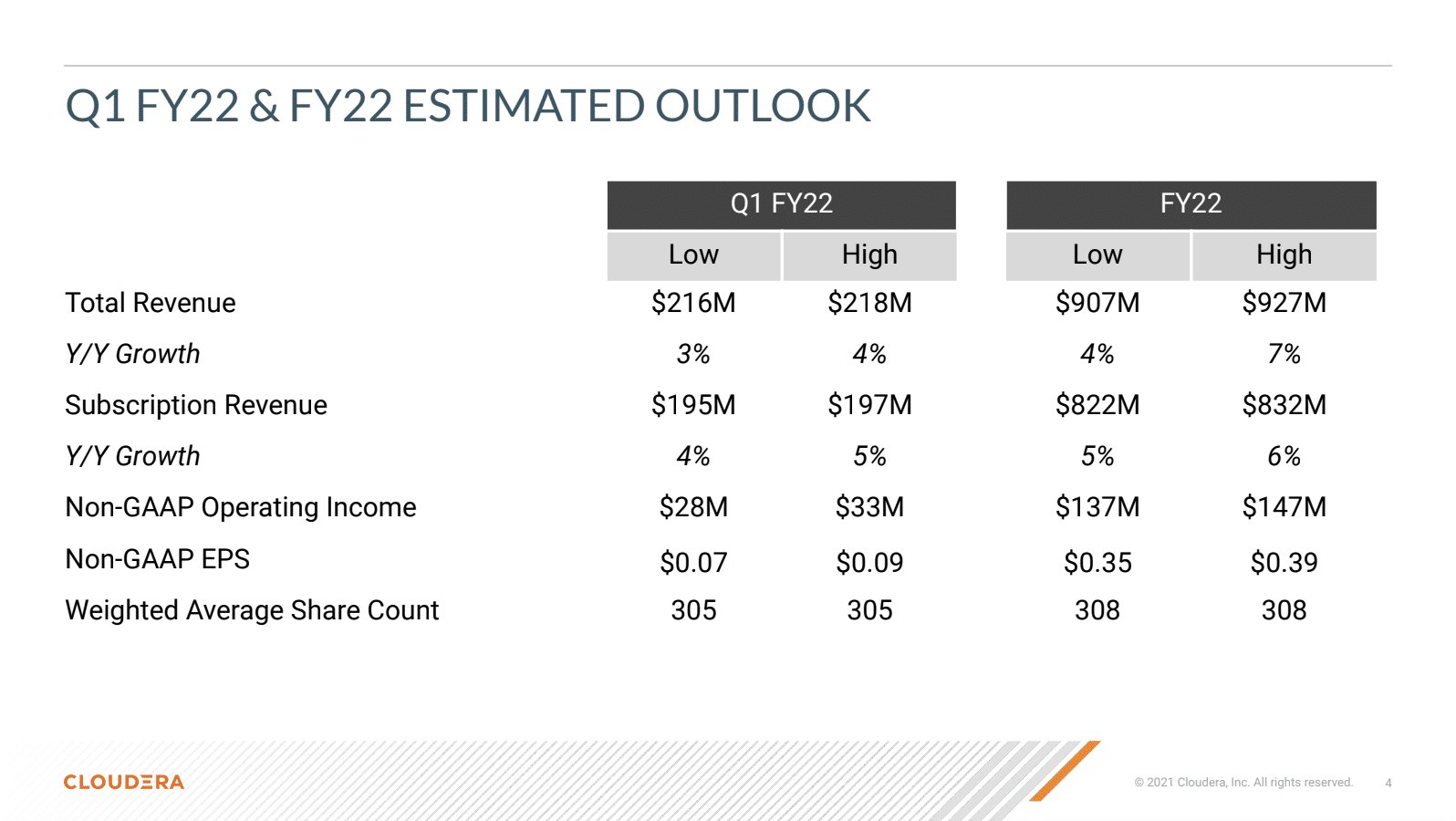

Outlook for Fiscal 2022 Q1 and the Full Year

For its first fiscal quarter for FY ’22, Cloudera is is on pace to grow around 4% from its FY ’21 result of $211.7 million, and subscription revenue of $182.0 million. This isn’t exponential growth by any means, but still encouraging, especially in a challenging economic climate is resiliency. Investors will continued to look for growth, most likely at faster rates, but Cloudera is showing such resiliency by not only beating expectations but growing on a YoY basis while continuing to innovate on its products and add customers to increase the annual recurring revenue.

Overall Impressions of Cloudera Q4 Earnings Results

Cloudera, while certainly in a competitive space, finds itself in a good position as the business of big data, AI/ML, and business intelligence continues to be a focus of enterprise IT and software investment. As the company’s solutions continue to offer significant value both in its capabilities and its economics, plus some key partnerships with fast growing public cloud providers, it feels like the next few quarters are well positioned to deliver continued success for Cloudera.

Futurum Research provides industry research and analysis. These columns are for educational purposes only and should not be considered in any way investment advice.

Read more analysis from Futurum Research:

Microsoft’s Move to Make Power Automate Desktop Free is a Major Power Play

Honeywell Recognized for Quantum and Pandemic Leadership

T-Mobile WFX Unlimited 5G Plans Take on Verizon and AT&T in The Enterprise

Image: Cloudera

Author Information

Daniel is the CEO of The Futurum Group. Living his life at the intersection of people and technology, Daniel works with the world’s largest technology brands exploring Digital Transformation and how it is influencing the enterprise.

From the leading edge of AI to global technology policy, Daniel makes the connections between business, people and tech that are required for companies to benefit most from their technology investments. Daniel is a top 5 globally ranked industry analyst and his ideas are regularly cited or shared in television appearances by CNBC, Bloomberg, Wall Street Journal and hundreds of other sites around the world.

A 7x Best-Selling Author including his most recent book “Human/Machine.” Daniel is also a Forbes and MarketWatch (Dow Jones) contributor.

An MBA and Former Graduate Adjunct Faculty, Daniel is an Austin Texas transplant after 40 years in Chicago. His speaking takes him around the world each year as he shares his vision of the role technology will play in our future.